Date:

05.04.2024 16:58

A contribution by

valuewalk.com

Here are two top small-cap stocks that investors may want to consider.

1. Turtle Beach

Turtle Beach (NASDAQ:HEAR) is best known for its gaming headsets, but it also makes other gaming accessories, like microphones, mice, keyboards and other devices. The stock has been on a tear this year, up more than 70% year to date as of April 4 to reach $17.60 per share — with more room to run. The consensus price target among analysts is $24 per share, which would be another 36% increase over its current price.

Turtle Beach generated a profit of $8.6 million in the fourth quarter, or 47 cents per share, up from a $23 million net loss in the same quarter a year ago. While the company’s revenue was down slightly, its earnings were boosted by a 17% year-over-year cut in expenses. However, the big catalyst for Turtle Beach going forward is its acquisition of a key rival: Performance Designed Products, or PDP.

As PDP specializes in gaming controllers, the acquisition will expand Turtle Beach into a new market. With PDP in the fold, Turtle Beach expects $10 million to $12 million in cost synergies and revenue of $370 million to $380 million in fiscal 2024, with adjusted EBITDA of $51 million to $54 million. The combined company’s revenue is expected to be some 43% higher than fiscal 2023, while its adjusted EBITDA should skyrocket more than 700% from just $6.5 million in fiscal 2023. Importantly, all these numbers include just nine months with the PDP addition.

Turtle Beach calls this a transformational acquisition, and that may be the case. With a forward price-to-earnings ratio of just 24, there should be excellent growth ahead for Turtle Beach.

2. SkyWater Technology

SkyWater Technology (NASDAQ:SKYT) is a semiconductor foundry, which means it makes semiconductors for other companies and organizations. It offers what it calls a technology-as-a-service (TaaS) model, working with companies in the aerospace and defense, healthcare, automotive, industrial, and consumer sectors to build their own chips. However, SkyWater doesn’t try to compete with the big foundries like Taiwan Semiconductor (NYSE:TSM); rather, it works with smaller companies and start-ups.

One of its biggest customers is the federal government, as it is Defense Microelectronics Activity (DMEA)-certified by the U.S. Department of Defense as a trusted supplier. In the fourth quarter, SkyWater received a $190 million award from the DoD. The company is now coming off a year in which it reported record revenue of $287 million, a 35% increase over the previous year. SkyWater posted a net loss of $31 million, or 68 cents per share last year, with an adjusted EBITDA of $37.2 million.

Looking ahead, the company sees its TaaS model, specifically, its Advanced Technology Services (ATS) business, as its growth driver. In the ATS business, SkyWater works with customers and clients to co-create innovative semiconductor solutions that fit their needs. Most of the ATS growth has been driven by its expanding relationship with the federal government and DoD. Last year, the ATS business accounted for about 79% of its total revenue, and in 2024, SkyWater expects ATS development revenue to grow by 10% to 20%.

Earlier this year, the company applied for funding through the federal CHIPS and Science Act to modernize and upgrade its equipment and expand production at its manufacturing facility in Minnesota, where it collaborates with the DOD on semiconductor projects. If SkyWater is awarded funding, which it likely will be, then that could provide an additional boost for the company.

SkyWater stock is up by about 16% year to date, trading at around $10.40 per share. Analysts set a consensus price target of $15 per share, which would be a 43% increase over the share price now. Given its unique niche and the growing demand for semiconductor technology, SkyWater should continue to generate returns for investors.

Disclaimer: All investments involve risk. In no way should this article be taken as investment advice or constitute responsibility for investment gains or losses. The information in this report should not be relied upon for investment decisions. All investors must conduct their own due diligence and consult their own investment advisors in making trading decisions.

Latest Posts

11.04.2024 15:47

New Partnership Could be Sweet for Krispy Kreme

10.04.2024 20:40

35 Idiotic Posts On Twitter That Got Shut Down By Clever Community Notes Comebacks

20.03.2024 18:13

Something Special? Why General Mills Stock is Up

02.04.2024 07:50

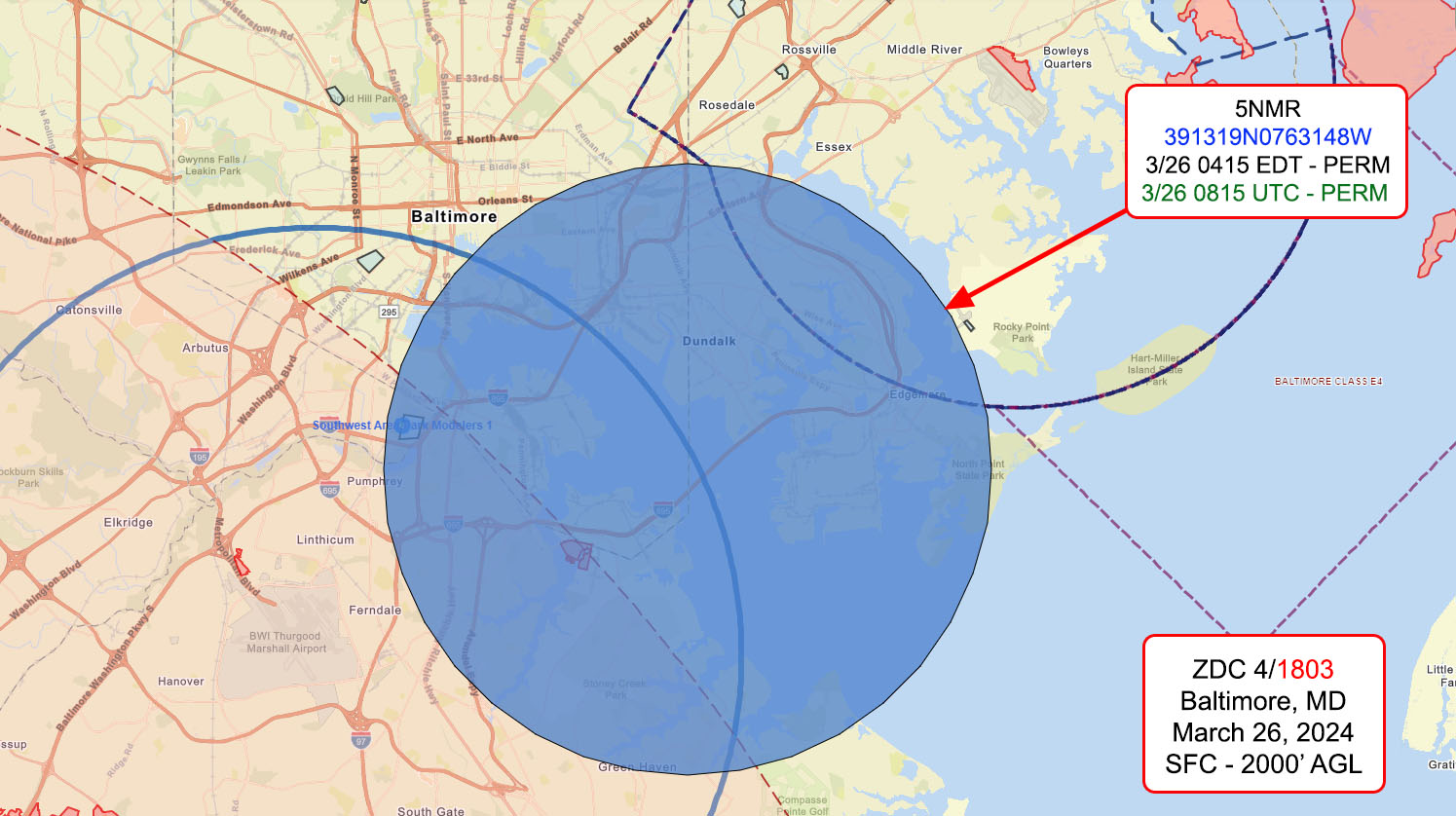

Officials issue warnings of Baltimore bridge no-flight drone ban

10.04.2024 14:02

Movies are Back: Cinemark Stock Could Have a Blockbuster Summer

17.03.2024 12:04

Comments