Date:

20.03.2024 18:13

A contribution by

valuewalk.com

Is the company cooking up something special investors should know about?

General Mills zigs when the market zags

The roots of General Mills date back to 1866, when Cadwallader Washburn built a flour mill in Minneapolis that eventually became General Mills in 1928. The company now encompasses more than 100 brands that are probably in most kitchens in the U.S. and around the world.

As a consumer staple, General Mills has been one of the steadiest, most consistent stocks on the market over the years. Over the past 20 years, the stock has finished the year in negative territory only three times, and in one of those years, 2017, it was down less than 1% for the year, making it essentially flat.

General Mills typically zigs when the market zags, as consumers tend to flock to its products when the markets are down and the economy is struggling. People tend to dine out less during such periods and look to stock up on General Mills’ discount food products.

This has never been clearer than in the past two years, as General Mills stock soared 28% in 2022 — when the S&P 500 was down 19% and the Nasdaq plummeted 33%. However, it was just the opposite in 2023, as General Mills stock tumbled 20% in 2023, when the S&P 500 was up 24% and the Nasdaq Composite jumped about 43%. General Mills mainly suffered from high inflation last year.

Over the past 20 years as of March 20, the company has posted an average annual return of about 9%, including its dividend — a solid, if not spectacular number.

Improving margins

This year, General Mills’ stock price is chugging along, rising about 6% year to date. It received a lift on Wednesday when it posted earnings and revenue that beat estimates.

The revenue number was nothing special, as General Mills posted net sales of $5l.1 billion in the quarter, down 1% year over year. However, over a two-year period, organic net sales were up 7% on a compound annual growth basis. The company likes to use the two-year metric because it compares its fiscal-2024 numbers to its fiscal-2022 results, which came before the historically high inflation rates kicked in.

In the fiscal third quarter, General Mills’ North American Foodservice segment saw 3% year-over-year sales growth, while its North American Retail business was flat. The Pet and International segments were each down 3%.

However, what investors probably liked the most was the company’s bottom-line results, which were buoyed by its Holistic Margin Management cost-savings initiative. That initiative resulted in a 16% reduction in expenses and improved earnings and margins.

General Mills’ net earnings climbed 21% year over year in the quarter to $670 million, or $1.17 per share. Further, its gross profit margin improved 100 basis points to 33.5% while its operating profit margin expanded 370 basis points to 17.9%. The company also boosted its operating cash flow through the first nine months of fiscal 2024 to $2.4 billion from $2 billion.

Old reliable

General Mills also reiterated its outlook for fiscal 2024, calling forganic net sales in a range between -1% and flat and adjusted operating profit and adjusted diluted EPS up by 4% to 5%. The company also expects free-cash-flow conversion to be at least 95% of adjusted after-tax earnings.

With solid earnings growth ahead, improved efficiency, and inflation trending lower, General Mills should be what it always has been — a good, reliable, defensive stock. Investors shouldn’t expect anything more than that, but to many, it holds a special place in their portfolios for its downside protection.

Latest Posts

18.03.2024 13:40

How to Build a Successful Postmates Clone App: A Step-by-Step Guide

22.03.2024 13:08

Top 5 Benefits of Factoring for Staffing Companies

21.03.2024 12:00

California Is Considering Charging Those Who Want to Leave the State With So-Called “Exit Tax”

19.03.2024 19:40

Why Choose ReactJS Development for Frontend Development?

09.04.2024 14:00

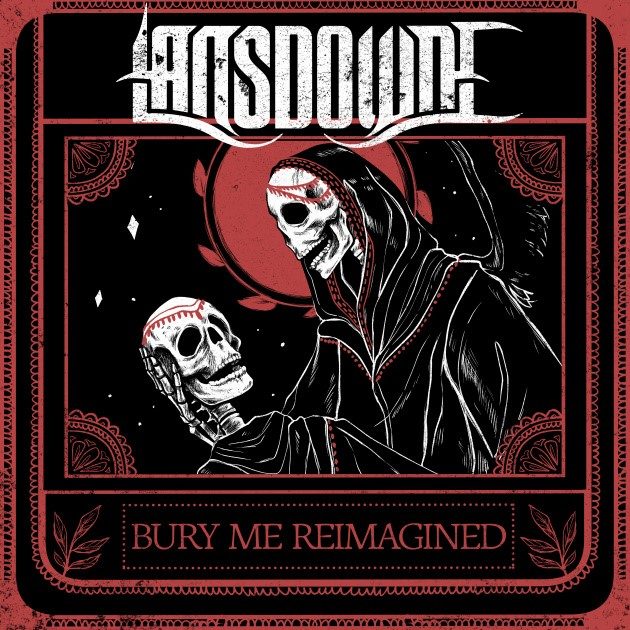

Lansdowne: veröffentlichen „Bury Me Reimagined“-EP und kündigen Tourdates mit Red an

17.03.2024 14:50

Comments