Date:

09.04.2024 13:55

A contribution by

valuewalk.com

Michigan tax relief measures that taxpayers can claim

On Monday, Gov. Whitmer joined State Representative Nate Shannon to discuss the tax relief available to Michiganders. The primary objective of the discussion was to ensure that taxpayers are aware of the credits available for retirees and working families.

“I am encouraging families to file their income tax and see if they are eligible for any tax benefits,” Whitmer said, adding that it is a “serious amount of money.”

Talking about the Michigan tax relief measures, the governor noted that the Michigan Earned Income Tax Credit (Michigan EITC) for Working Families is available to working individuals with income below the set threshold.

Whitmer informed that the state expanded the Michigan EITC from 6% of the federal EITC to 30%. According to the data from the Internal Revenue Service, Michiganders claimed an average federal EITC of 2,587 last year, and prior to the changes, the average Michigan EITC was $154.Also, the governor noted many seniors will benefit this tax season from the Retirement Tax Repeal. The Retirement Tax Repeal, which was part of the Lowering MI Costs Plan, is estimated to offer $1,000 to about 500,000 households.

“Last year, we rolled back the retirement tax and quintupled the Working Families Tax Credit, saving hundreds of thousands of Michiganders money on their taxes,” Gov. Whitmer said in a statement at the start of the tax filing season.

Lowering MI Costs Plan: what is it?

The Lowering MI Costs Plan provides taxpayers with more taxing options for their retirement benefits for the 2023 tax year. This new law, over a four-year phase-in, will restore the pre-2012 retirement and pension subtraction for most taxpayers in the state starting 2026.

Retirees need to file their return to benefit from the expanded retirement and pension subtraction options. The use of new options will help taxpayers save time, as well as eliminate the need to file an amended return. Thus, it is important for retirees not to delay filing their tax returns for tax year 2023 to claim the best pension and retirement benefit subtraction option.

Taxpayers are encouraged to file their return electronically and select direct deposit for refund. This method is considered to be convenient, safe and secure. Last year, about 4.7 million Michiganders, or about 90% of state individual income tax filers, filed their return electronically.

Low-income taxpayers, those with disabilities, or those aged 60 or above may qualify for free tax preparation help from IRS-certified volunteers. Visit www.mifastfile.org, or go to irs.treasury.gov/freetaxprep or dial 2-1-1 for more information on filing taxes.

Latest Posts

19.03.2024 20:00

Unlocking the Power of Exploratory Essays: Your Ultimate Guide

21.03.2024 22:10

Brushstrokes of Brilliance: Unveiling the Multifaceted Poster by Andrzej Pągowski

17.03.2024 20:31

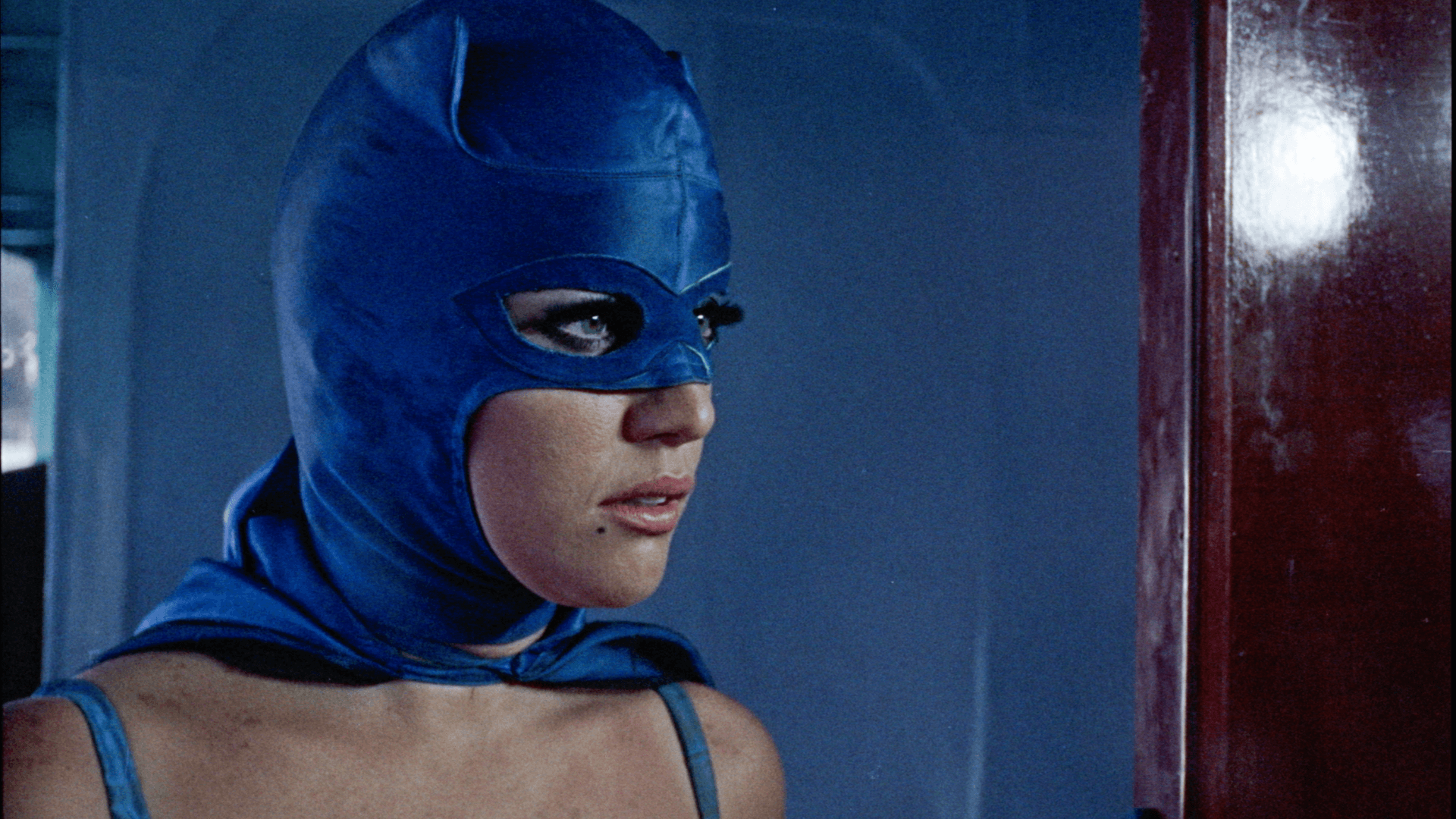

The Bat Woman – Indicator

09.04.2024 19:04

10 Ways to Tell a Restaurant is Bad and You Should Avoid it

05.04.2024 16:42

Uplift Harris Guaranteed Income Program: $500 Coming This Month

06.04.2024 14:57

Comments