Date:

22.03.2024 15:06

A contribution by

valuewalk.com

Property tax relief from Wyoming: bills the governor approved

On Thursday, Gov. Gordon signed into law property tax relief bills that were approved during Wyoming’s 2024 budget session. The governor signed the following tax relief bills: House Bill 45 (Property tax exemption-residential structures and land), House Bill 3 (Property tax exemption for long-term homeowners) and Senate File 89 (Veterans ad valorem exemption-amount).

“I am happy to sign this package of legislation, which provides targeted relief to taxpayers most impacted by increasing valuations, while ensuring our counties and schools are able to provide the services our residents rely on,” Gov. Gordon said in a press release.

HB3 offers a 50% exemption of the property’s value, provided the property is used as a primary residence, the primary owner or the spouse is 65 or older and the owner has paid property taxes to the state for 25 years or more.

HB45 puts a 4% cap on the annual property tax increases on residential structures and land. Lastly, Senate File 89 doubles the veteran’s tax exemption to $6,000 (from $3,000) of assessed value.

Bills that the governor vetoed

Gordon used his line-item veto authority on House Bill 4, the Property tax refund program, to remove the highest income category. HB4 created three different tiers for different income brackets. Although the governor signed the bill, he struck the top income tier.In his letter explaining the decision, the governor said the bill expands the needed relief, but the $20 million appropriated for the program would be insufficient to achieve the program objective if the highest income category was included. Further, the governor added that he is not in favor of extending the program to those who make up to 165% of the county median income.

Gordon vetoed Senate File 54 (Homeowner tax exemption), which called for a 25% exemption to the first $2 million of a home’s fair market value.Explaining the reason for vetoing the bill, the governor said the bill “would have only provided a temporary and very expensive tax exemption to all Wyoming homeowners at the expense of other taxpayers in our energy industries, retail and manufacturing sectors.”

In addition to bills related to property tax relief from Wyoming, the governor also issued a line-item veto to HB0166 (Education savings accounts-1). He vetoed SF0067 (Public employee retirement plan-contribution) as well. Further, the governor allowed some bills to go into law without his signature.

Lawmakers won’t be able to override the governor’s decision as they are no longer in session.

Latest Posts

30.03.2024 18:25

Explore the Convenience and Joy of Online Cake Delivery in Pune

18.03.2024 14:28

Analyzing the Growth of P2P Crypto Exchange Development

10.04.2024 12:00

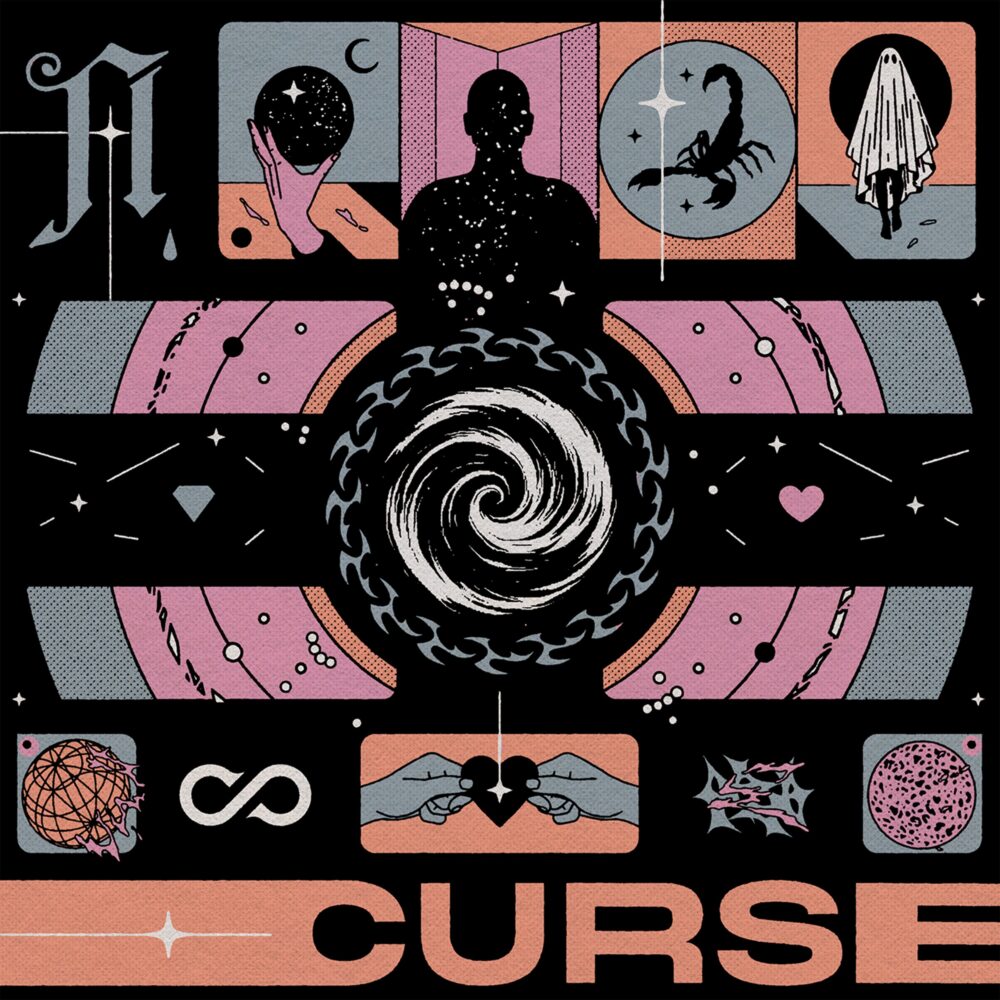

Architects: veröffentlichen neue Single „Curse“

19.03.2024 19:14

What is the Cost of Developing a Website for a Small Business?

28.03.2024 15:00

My one desire is to show God’s heart through worship.

02.04.2024 17:46

Comments